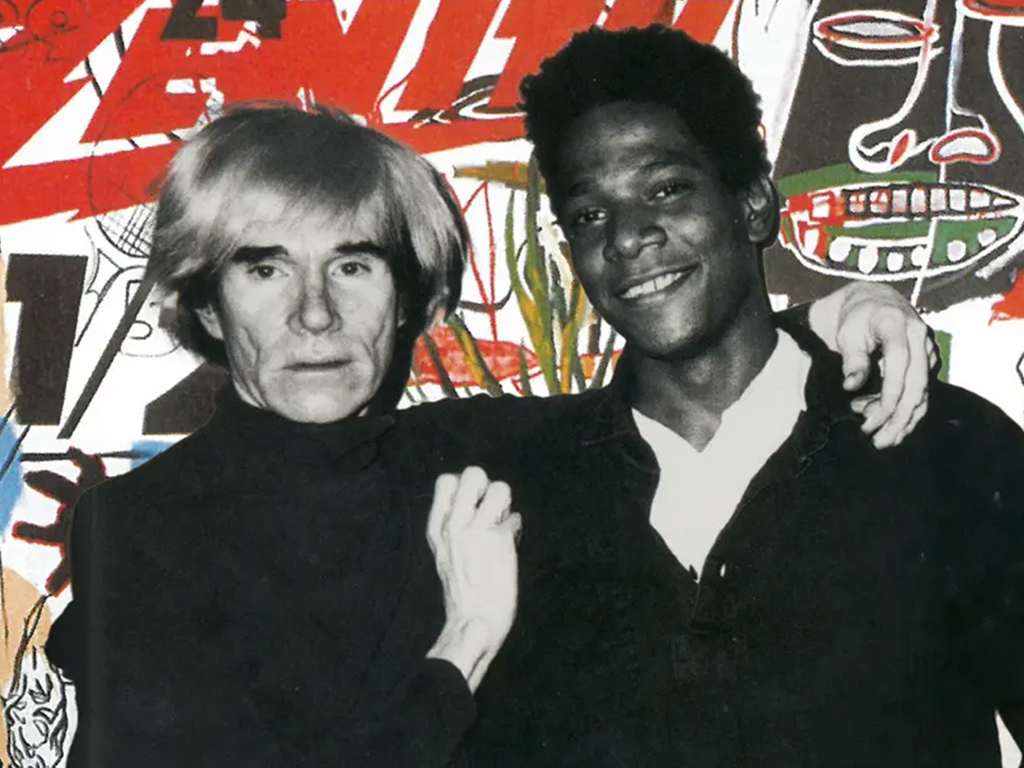

Earlier this month, an artwork by Andy Warhol and Jean-Michel Basquiat, Untitled (1984) was sold at Sotheby’s New York for $19.4 million, breaking the record for any joint artwork sold at auction. This sort of news story isn’t all that unusual – sales in the art world are filled with record-breaking headlines, often accompanied by dazzling price tags. Despite the excitement of these sorts of sales, however, investing in art is much less of a gamble with multi-million-dollar stakes than it might seem from the outside. Art investment is a hugely popular wealth management option that can offer long term growth as well as a chance to take a personal interest in your investments. If you are trying to decide if you should invest in art, here are the first things you should know.

Art as an asset

While the purchase of any artwork with a significant value might be viewed as an investment, art is actually considered its own asset class in the investment world, with a number of benefits:

- Art is not tied to the market as directly as equities and bonds, and as a result can be more resilient in times of market change.

- Usually, art appreciates in value slowly over time, and the value is held in the physical artwork itself. This can add a stabilising element to an investment portfolio.

- The art market has significantly increased in value over the past few decades, even taking after dips and rises into account. According to Citibank, the art market had annual returns of 8.3% over a thirty-five-year period from 1985 to 2020.

The market also bounced back following a dip in 2020, as reported in the Art Basel & UBS Art Market Report 2024. While this growth has now eased, global art sales in 2023 still remained higher than they had been before the pandemic, attributed in part to the growth of the online art market.

In recent reports, art has outperformed other luxury asset classes such as watches, according to the 2023 Luxury Investment Index from Knight Frank. The agency noted a 30% increase in art sale prices over a 12-month period ending in June 2023. By comparison, the FTSE 100 rose only 5% over the same period.

There is, of course, a benefit to investing in art that almost no other investment will have: the pleasure of enjoying the art itself. You can curate your collection to reflect your own tastes, and even if you are buying with the express intent to sell later on, you can display the artwork in the meantime to get the most out of it.

Risks of investing

As with all investments, art carries some risk to the investor. There are a few factors that are particular to art investment, however, that are worth keeping in mind:

- Art value is tied to the value of the artist. This should be considered when making a purchase, as the artist’s previous sales and ROI can indicate where the trajectory of their work’s value is headed. Future success can result in a huge increase in value, while failing to live up to expectations can lower the art’s anticipated worth.

- Art is a non-liquid investment. While the art market itself shows steady growth in the long term, it is subject to trends and fluctuations like any other market, and you can’t guarantee how quickly you will be able to find a buyer for your art when you want to sell it.

Despite these risks, art is still considered a worthwhile investment. To lower the risks to your overall wealth management plan, experts recommend art as part of a broad and diverse portfolio.

Passion or Profit

If you ask an investment expert how to buy art, the advice you receive will vary; usually, depending on how the expert themselves views art. Some will tell you that you need to leave emotion at the door, looking solely at artworks that offer an opportunity to buy low and sell high. Others will tell you to focus on art that you love, as you will be investing in your own enjoyment as well as the art itself.

As an art marketplace, we certainly believe in art for art’s sake. However, there are steps you can take to ensure you choose art with investment potential at the same time:

- Authenticity is key to reselling any artwork; when buying, make sure you obtain documentation to prove that the artwork is authentic through a signature, certificate of authenticity, and/or provenance papers.

- Rarity will often be the strongest driving factor behind the value of an artwork. This means that original artworks will often carry the highest value, as well as a higher percentage return when it comes time to resell. Rare prints will also hold higher value than editions with large numbers.

- Expert advice is essential to navigating art investment. Art is always subjective; ensuring a good investment means understanding both the art and its place in the market. An expert can offer informed advice both on what to buy and when to sell.